Loan/EMI Harassment from Banks, NBFCs, Online Loan Apps Recovery Agents

Loan Moratorium was provided by RBI India from March 2020 till August 2020 Due to this Pandemic year in 2020, Many working capital or Middle class borrowers have Job Loss or Pay Cut or Business Loss till August 2020 and still they didnt recover from it.

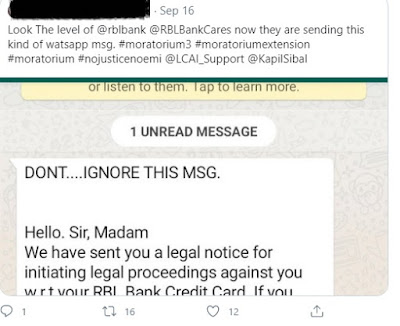

But Banks/NBFCs/Online Loan Apps started calling them, Calling their friends, Harassing them from September 1 2020. I can see so many tweets going on in twitter with hashtags #moratorium #moratoriumforall #moratorium3forall #moratorium3 #OperationHaftaVasooli #Vasooliband #extendmoratorium and more.

But Still there is no relief for them even Top Supreme Court had put Interim Order till September 28 2020 for No Loan Accounts should be entitled to NPA for whatsoever reason it is.

But Still I see so many audios and videos and pictures circulating in twitter where Banks are still harassing people through unknown recovery agents and forcing people to pay their EMI or dues for their Loans which they cant pay due to their genuine reasons of it.

This Page is dedicated to those people and i will be exposing all those banks here either with proof or with tweets picture of it.

GOOD BANK LISTS

1. CITI BANK [NO HARASSMENT EVER]

TO APPLY FOR CITIBANK CREDIT CARD GENUINELY CLICK HERE

1) Bajaj Finance (WORST *****)

2) IDFC Bank (WORST *)

3) SBI Credit Card (WORST ***)

4) RBL Bank (WORST *)

5) Axis Bank

6) IndusInd Bank

7) ICICI Bank

8) HDFC BANK ( WORST **)

No Loans or deposits or transactions ever from moratorium supporters here from NOW on. More list will be added soon accordingly.

See How Wificash is intimitidating this person and forcing him to pay the loan when he is really struggling to even get his business back in this pandemic year 2020. Atleast Professionally Wificash can give some time to him to get the Loan recovery in a decent way possible than going against Supreme Court interim order till Sep 28 2020 and RBI guidelines of FAIR Policy of Loan recovery with customers.

2) MoneyMore Loan/EMI Harassment with Proof

See How MoneyMore is intimitidating and Harassing this person and forcing him to pay the loan , Also it blocks the Aadhar card of him. They are just bullying him to put photos in social media with documents and maligning him and defaming him to recover the money LOAN. Is this what RBI's Fair Policy meant too? Is this how customers will take loan and suffer in future? Who gave them support? Who gave them the rule to expose customers?

4) PaisaLoan Loan/EMI Harassment with Proof

What to do if repeated Harassment and Recovery done from Banks/NBFC/Online Loan Apps?

Instructions to file a complaint here in Reserve Bank of India Website for this matter here

Minimum Requirement for Filing a Complaint

Approach the Office of the Ombudsman concerned, along with the following details (as

applicable);

1. Your name and postal/billing address with

→ Telephone No.

→ Fax no.

→ Email address

2. Name and address of the branch/bank/entity or its registered office against which you

are complaining

3. Facts of the case with supporting documents (if any).

4. Your Account number/it card number for card related complaints/other details

5. Nature and extent of the loss caused and relief sought thereof.

6. Any other supporting documents

Look How to File A Complaint With RBI India - Video Gallery Available here

Excellent more power to you

ReplyDeleteHdfc, Aditya birla, IDFC, IndusInd, RBL, Fullerton india this bank daily harressing me.

ReplyDeleteIndusINd, Even after going for monitorium they started collecting after one month

ReplyDelete